@Rays

2018-04-19T10:53:18.000000Z

字数 15058

阅读 2363

为什么说99%的区块链初创企业纯属扯淡

区块链

摘要:

作者: Jamie Burke

正文:

你是否感觉区块链是一派胡言?你是否试图去理解从中能有什么钱可赚?站在你现在所处的位置并举手大喊“全是扯淡!”,这种感觉很好吧?正如文章题目所说,我认为区块链炒作周期(稍后我称其为“扯淡周期”)中的关键之处都是扯淡。这些观点现在听起来非常负能量,但是我将分享我的做法,实际上这是一个非常有利可图的机会。

在深入阐述原因和做法之前,先介绍一下我是如何得出我的观点的。读者可自行判断为什么我的观点至少是值得考虑的。

注意,本文内容略长(估计阅读15分钟)。对于这样的论点,理应做出适当而细致的解释。在你做出回应之前,将本文保存下来并在有时间时阅读一下。

背景

所以让我们开门见山。听到所有人都称之为胡扯已经很久的拉拉队长,听起来可能令人震惊。 我是Outlier Ventures的联合创始人,Outlier Ventures是欧洲第一家致力于区块链空间的风险投资商和基金,于2014年成立。在我成为投资者之前,我是一家创新和变革代理,与世界上一些最大的公司合作 2.0周期,所以它不是我的第一个牛仔竞技表演。

So lets get unpacking. Hearing me of all people call bullshit having been a long time cheerleader might sound shocking. I’m the co-founder of Outlier Ventures, Europe’s first venture builder and fund dedicated to the blockchain space, setup back in 2014. Before I was an investor I was an innovation and change agent with some of the world’s largest companies in the Web 2.0 cycle so it’s not my first rodeo.

- I’ve been investing in blockchain for the last 4 years

- With my team we’ve met 1,220 startups. That’s almost 1 a day

- I’ve seen 800 pitch decks from 18 countries

- I’ve hosted multiple pitch days around the world.

I’ve facilitated $22m in deal flow. A large part interestingly coming from corporate venturing arms.

Outlier’s venture platform itself has gone onto build a portfolio of 4 ventures from scratch all now with customers. Some we talk about some we don’t.

Note: you can find the full list of the 1,220 startups here.

Framing:

In short I’ve dedicated a lot of time looking at this space from many angles whilst trying to figure out what sustainable* commercial models could exist that can offer high-growth potential in an emerging paradigm.

*For the purpose of this discussion ‘sustainable’ means startups that have a long-term, profitable and high-growth future beyond life as an SME. This a company that could scale in its own right rather than only if they are acquired by a major player. I appreciate you may have your own definition.

Some VCs might not always care about long-term sustainability if they feel they can get a quick exit. This is especially true if they are a new early-stage fund and necessarily not able to follow into later rounds therefore themselves face lots of dilution. From a liquidity perspective it’s also very attractive to have some quick exits in your portfolio mix. But in reality if you don’t know how they could become sustainably profitable you are kicking the can down the road onto an unsophisticated market before it pops. This is a great opportunity when it’s a new paradigm no one really understands like blockchain. In fact that is the very essence of a bubble. In short the position I am about to share with you is contrary to the one on face-value you would think I should take.

So why don’t I just shut up and hope I can take advantage of the rest of the market who hasn’t cottoned onto its fundamentals yet? Maybe it’s because I’m a nice guy but more believably it’s because I think there is greater risk for my investors and I in backing startups we don’t think have genuinely sustainable businesses. Ultimately I want to see fewer losers and more winners even if we have to share them. I want to grow the market.

When I say 99% it is meant figuratively, but actually if 90% of everyday startups fail in their first 3 years, 99% in blockchain may very well be close to actuality based on the thesis I am about to share. If you apply the math to the 1,220 startups in our tracker that’s 12 that will ‘succeed’ in line with my definition of sustainable. Which feels about right. But the important point here is principles not numbers.

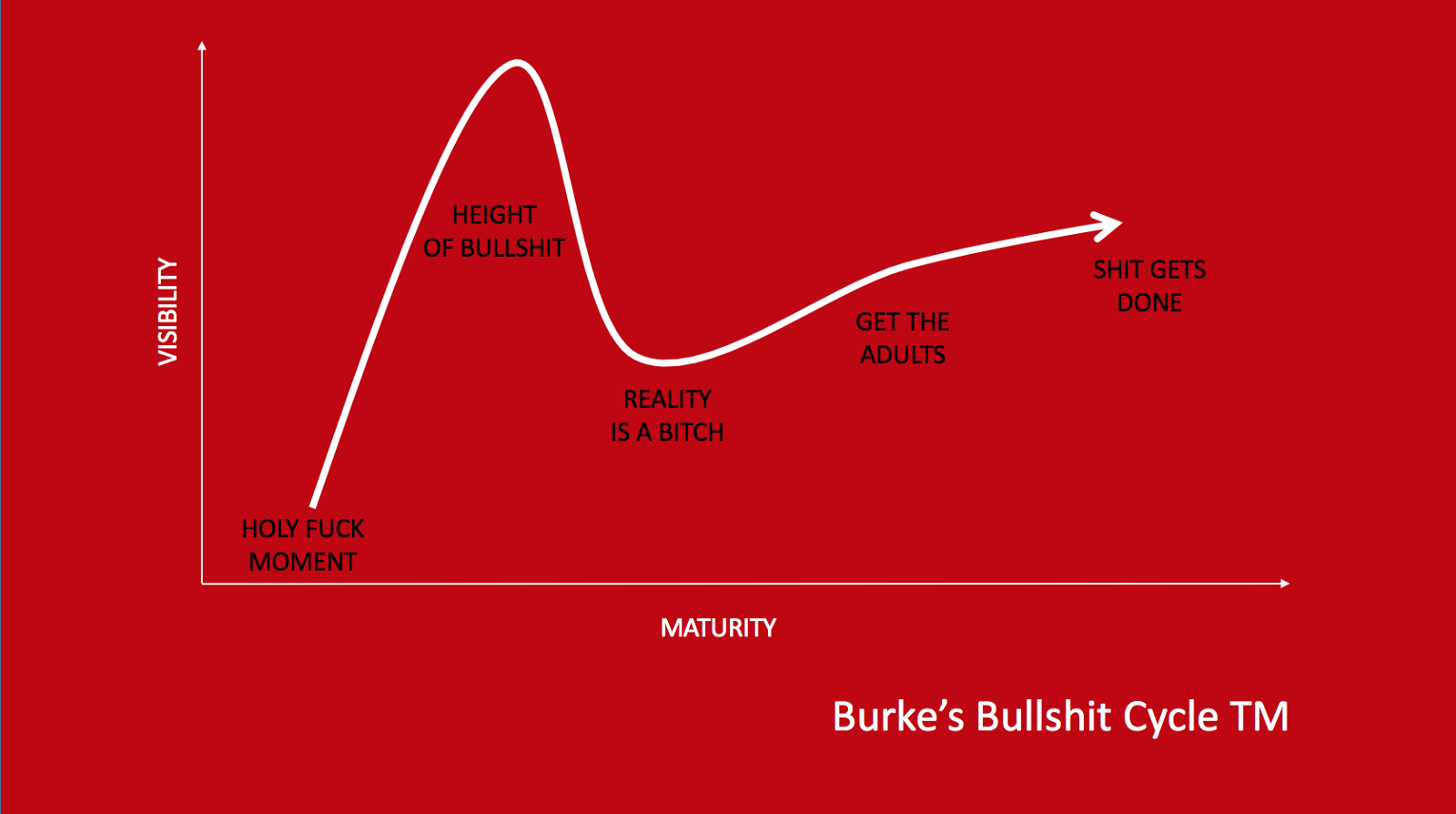

Understanding The Bullshit Cycle:

As you now know from my intro I believe you would be right to call bullshit on significant parts of what’s going on in the blockchain hype cycle or as I like to call it the ‘bullshit cycle’.

The central idea of this cycle is there will always be bullshit with any emergent tech. Not necessarily bullshit to deceive. This isn’t Trump false news. Just largely naive optimism. The kind needed to believe you can change the world. And that’s what’s great about it. It’s the most ambitious initiative since The Web itself, in fact it is the next phase of The Web. Web 3.0. So it’s only natural it’s reach is going to exceed its grasp in the early days.

Now when that community can self-finance with the untaxed (wink wink) capital gains from the tokens that underpin it, aka ‘crypto equity’ like Bitcoin or Ether, there are no limits to it’s ambition. Furthermore it elongates the cycle because hype benefits holders and even makes usually very sane people ignore the elephant in the room. If you have been a casual holder of Bitcoin, or had a company that somehow accumulates Bitcoin, you have witnessed a once in a life-time investment opportunity and it’s still got some way to go despite the recent SEC decision. But this masks what’s really going on here.

I’ve watched in disbelief at the big early bets made in the blockchain space over the last few years by some the best regarded Valley names. Many laughed at the European VC who largely kept his or her hands in their pockets and dismissed them as just ‘not being able to get it’. In fact they were unable to get it because perhaps there was nothing to get. For once European caution might actually have been genuine discernment. If you wanted to be cynical you might argue those VCs who went long may have now realised they made the wrong bets but hope to exit their positions before the rest of the market figures it out. Maybe they just don’t want to believe it. Maybe they just haven’t figured it out.

So yes there has been a lot of bullshit and that’s ok because its normal to any hype-cycle only this one is more pronounced. For those deep in the space I believe we are in the ’reality is a bitch’ phase. For everyone else it really depends on which geography you are in. The UK is different to say India or Japan and furthermore it depends what sector you are in and even which company department.

But our industry continues to professionalise. The Enterprise Ethereum Alliance is a great example that we have ‘gone to get the adults’. I was keynoting on this very topic at an Airbus conference last week in Hamburg to an audience including BMW, Innogy and Siemens. Whilst I couldn’t get anyone to shout out ‘’bullshit’’ (trust me I really tried) my message resonated with many in the room who all shared a growing sense that most of the POCs they are seeing just don’t make sense commercially.

Now please understand I don’t say this to denigrate some of the great people we have met over the years. $1.6bn+ in infrastructure has been laid down for us all by these pioneers which we should be VERY grateful for. For many laggards just joining the party they are going to get the free ride of their life. But sadly I just don’t see sustainable business models in most of it, that is in and of itself, for the guys out there busting their asses off to build it. So I am compelled to speak out.

Yes the title is shameless click-bait but I say this genuinely to help startups , and as you will read shortly, to offer a solution to hopefully save them wasting many years of their life building something that gives no pay-off for them or their investors. In fact forget investors they can afford to lose a few bucks but for an entrepreneur you can never get that time back. That time is immensely precious when you are sacrificing being with your loved ones and families.

问题的根源所在

So let’s get to the root of the problem. The question I get asked all the time on panels is what is the first killer app? After seeing 1,220 startups I share Vitalik Buterin of Ethereum’s view:

There is no killer app just a infinite list of long-tail use-cases across every conceivable industry. (I slightly paraphrase here)

So at Outlier Ventures we never have* or ever will* invest in blockchain infrastructure. Generally I believe that this is best done by the community through token sales where openness is important and the value is in the crypto-equity itself or a consortia when privacy, speed and security are the required characteristics. In both cases there is no point in owning it as it will very quickly become commoditized with a downward race to zero.

** the one caveat I use here is this is unless said infrastructure is a stepping stone towards a bigger aim which will become clear shortly. But the point still holds there is no point in owning it. Just give it away.*

I also don’t invest in companies solely focused on SaaS ‘dumb contract’ models. I say ‘dumb’ because there is often nothing ‘smart’ about most smart contracts today. It’s often very simple if-this-then-that. And because anyone in principle can audit them anyone can copy them and make them cheaper. This downward pressure on price makes it very difficult to finance a startup that needs a lot of capital to reach profitability. I believe this slow realisation is why very often blockchain startups lead investors who have done an A round don’t follow.

Now IMHO one of the ways these startups can become commercially sustainable and avoid this downward pressure is if they can successfully leverage machine learning somehow. It’s this combination of technologies that I like most because guess what: machine learning likes big standardised data sets and ultimately I believe this is the main promise of ‘blockchain’.

So this is why I use the *, because many blockchain startups should think of themselves as an AI company where the blockchain stack is really a trojan horse to incentivise an industry to open up and standardise data silos. And guess what ML value compounds so if you can build genuinely smart contracts ahead of the curve you can build very defendable and highly profitable monopolistic positions.

Understanding Blockchain+:

So at Outlier we don’t invest in ‘just blockchain’ companies. Our conclusion is most on their own are likely pretty useless. Often it’s just technology looking for a problem with few defensible moats sadly by teams that have little real understanding of the domain they are trying to apply it to. Maybe some will make a buck for a while. If they are happy being an enterprise software consultancy they can even make a great living. They might even sell to the usual suspects looking to acquihire or driven by FOMO but these will be few and far between.

So instead we invest in something called ‘blockchain+’

This is where blockchain is foundational to another technology and specific to a domain. This later part is very important when you are building an AI company. The consensus among VCs investing in this space is you need to be a ‘full stack’ company. That means just building the AI is a road to nowhere, you need to be building the full company that leverages the AI to get lock in.

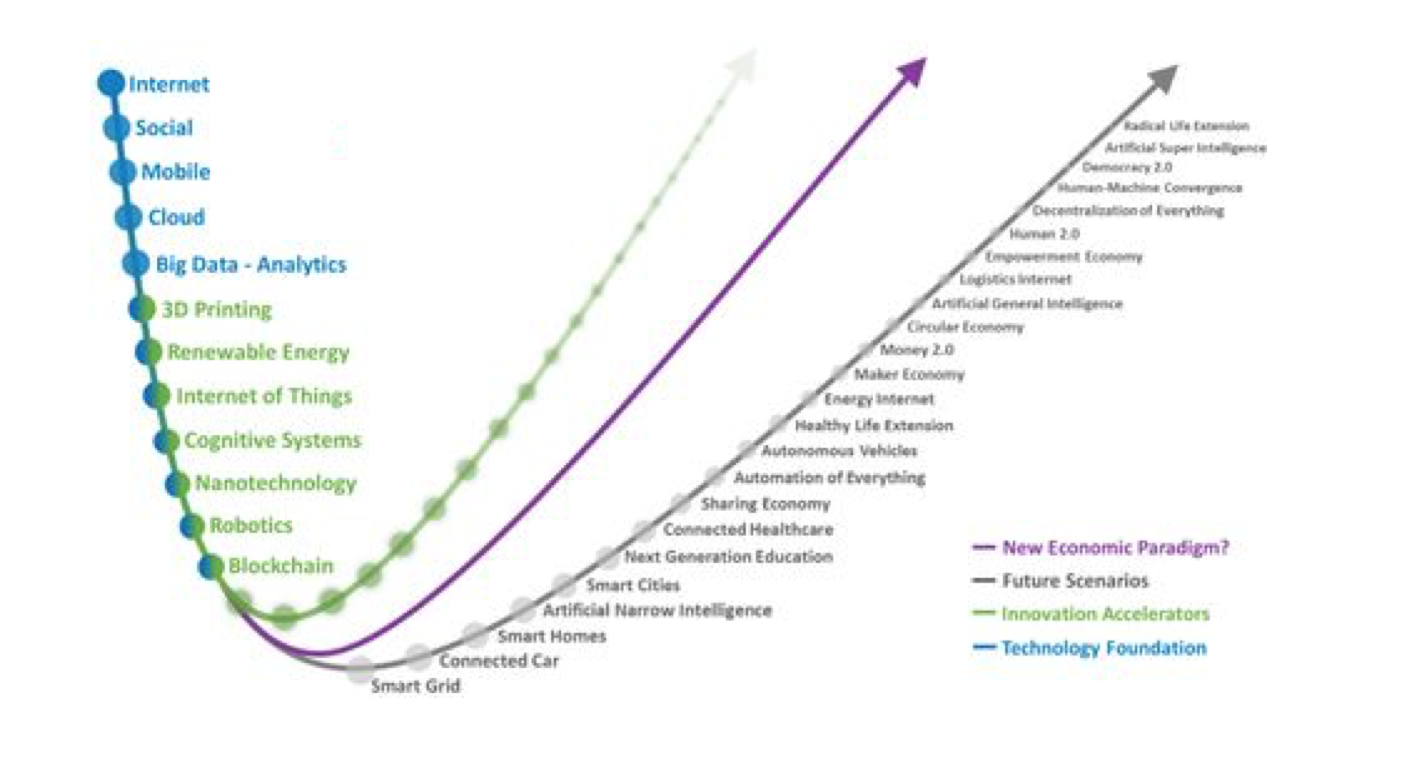

For me ‘blockchain like’ technology is most interesting when thought of as foundational to the 5 technologies listed above to help them scale and scale securely. I say ‘blockchain like’ because there might not be any blocks being hashed or mined. What is important is does it enable more a decentralised economy where immutability is non-negotiable and there is some form of native token.

So let’s explore an example of blockchain + when applied to 3D Printing.

Problem: The reason why people are still largely 3D printing Star War figures rather than Rolls-Royce engines is because, like any other digital files for music and film, CAD files can be copied innumerable times and shared widely. This lack of copyright control is further amplified when it can be printed innumerable times too.

So if you want to print anything of value the owner will carry the file on a USB letting it nowhere near the Internet whilst making sure you don’t copy the file locally when you are printing it. Having to physically transport the design file totally defeats the point of being able to produce at the edge when and where the goods are needed. Yes you can shard but doing this on a centralised system has many vulnerabilities. And who owns it?

Solution: Enter blockchain technology. The CAD file becomes as unique as a Bitcoin where there can only be one owner at any time on a shared and cryptographically secured ledger. Printers become wallets with read-only access to the file on a per-print basis using an open source software install. All transactions are auditable on the shared ledger with proceeds from royalties automatically distributed instantly via smart contracts to any number of participants including the tax man. To involve a network of so many stakeholders requiring automated and secure payments it must be decentralised on a blockchain.

Example: There are at least 4 entities we know trying to tackle this problem today:

- Cubichain

- Genesis of Things (Cognizant + Innogy)

- 3D Plex

- UbiMS

So add these technologies together and this means really we are investing in having an advantage in the next $13 trillion computing cycle. We invest AI startups, IoT startups or drone startups that get and know how to use and implement blockchain like tech but less so the other way around.

Convergence Thesis:

Blockchain + however isn’t where this ends. It could increasingly mean these technologies have an increasingly common infrastructure that shares similar principles and standards. This doesn’t underestimate the messy job of inter-operability between a universe of blockchains but it does assume somehow its figured out.

Believe this assumption and it means these technologies can convergence and combine acting as accelerators to one another. And this is when shit gets really crazy. It’s a thesis we coined at Outlier Ventures back in November 2016 called ‘blockchain enabled Convergence’ aka ‘Convergence’. You can see the white-paper here and its why we now turn away most blockchain startups.

We’ve got some big plans for investing in this thesis over the coming years and are putting in place some significant financial firepower to back those few startups that get it, hopefully all the way (more over coming months). Which is why long-term sustainability is more interesting to us than just quick exits.

That’s why now Blockchain Angels, the syndicate that allowed us to meet 1,200+ startups and form this thesis, will now only support ‘blockchain +’ startups via an Angel List syndicate called Convergence VC. It will begin to push out deals in the next couple of weeks so please do FOLLOW US.

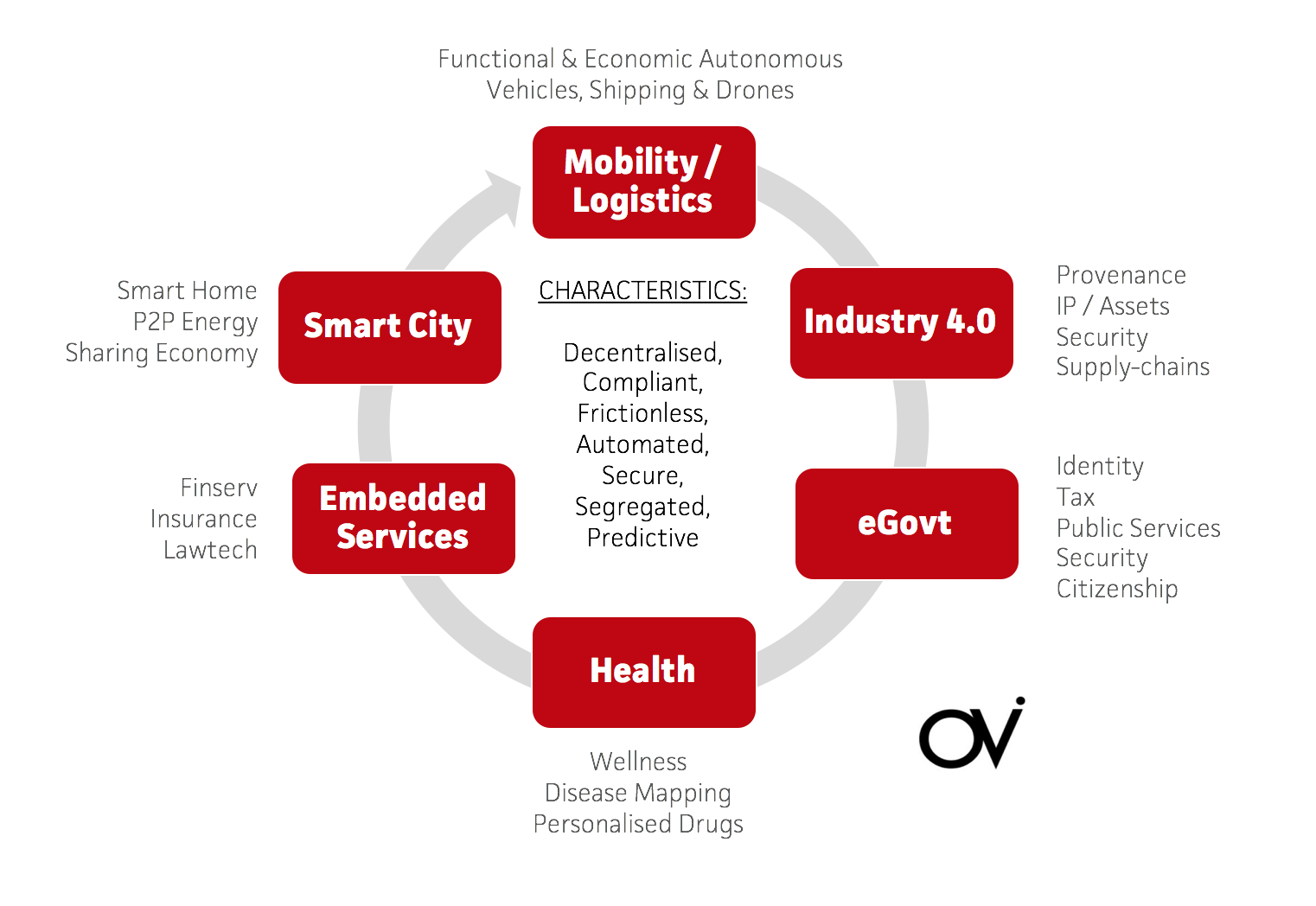

Convergence Verticals:

To expand on this thesis a little more we believe Convergence is most relevant when applied to some key industries:

- Industry 4.0

- eGovernment

- Health

- Smart Cities (inc. Energy)

- Mobility & Transportation

- Embedded Services*

*By Embedded Services I mean invisible; fintech, insure tech, lawtech and regtech that follows machines and people around as they navigate Web 3.0.

Combined Convergence innovations in these verticals enable what I term ‘The Smart Economy’ which is a rules-based, frictionless and self-optimising economic system that spans from heavy-industry to everyday life. It is enabled by the decentralised Web 3.0 woven through how we travel through to our health and homes. To realise it requires cross-industry lateral collaboration at the inter-section of numerous technologies and industries.

Note what most of these industries all have in common: they are heavily regulated, at least in The West, which means they are almost impossible to disrupt. But you can significantly transform them and that’s exactly what Convergence will do.

Addressing The Capital Gap:

Now what’s interesting from an investor’s perspective, because of the sheer level of complexity investing in Convergence, it can not be funded by retail investors and even teams of professional VCs on their own don’t stand much of a chance because it requires:

- Expertise in multiple deep technologies

- Ability to timeline their convergence

- Serious domain expertise for the various fields of application

So there will be a capital gap in seed which is a big problem for an ecosystem that is heavily R&D based and capital intensive. Now think of the missed opportunity in Industry 4.0 alone. According to Boston Consulting Group Industry 4.0 is estimated to provide productivity gains of up to 8 % over 10 years in Europe, totaling €150 billion. In Germany alone it will contribute 1% per year to GDP over next ten years. And that’s without convergence factored in.

The b2b market is for me by far the most real, relevant and interesting for blockchain +. So the startups wanting to enter this space also need more than just capital they need access to the incumbents early on. Which is why as a venture platform we invest so much time and effort in forging deep relationships with incumbent enterprise for our portfolio. This is so they can access the right people at the right level and align their road-map to the strategic needs of clients. Ideally they do this before they write a single line of code. This shortens the sales-cycle, therefore the runway required and in part de-risks the investment. It gives access to deep domain expertise and real businesses with real pain points and deep pockets.

Join The Community:

So that’s why today we are formally launching Convergence.vc to help cut through the bullshit and bridge these two worlds to finance the ecosystem that is going to enable this incredible period of economic growth. In fact this requires much wider international cross-industry collaboration so we aim to bring together a whole raft of players together through regular meetups and thought leadership including:

- Regulators

- Academia

- ERP IT Companies

- Change Consultants

- Security Firms

- Deep Tech Early Adopters

You can join us at a meetup group in a city near you from Boston to Berlin or Tokyo by following what we are up to here at Convergence.vc There is also a blog tracking developments in this space complete with monthly newsletter and weekly podcast.

本文作者简介

CEO & Investor at OutlierVentures.io focused on the convergence thesis: where blockchain is foundational to Web 3.0 a more decentralised and automated future.