@fanxy

2018-04-23T07:52:22.000000Z

字数 3991

阅读 3268

二、动态最优数学基础

樊潇彦 复旦大学经济学院 数量经济学

0. 准备工作

setwd("D:\\...")rm(list=ls())install.packages(c("nleqslv","deSolve","scatterplot3d"))install.packages(c("zoo","quantmod","tseries","fBasics","forecast")) # 时间序列常用包library(dplyr)library(tidyr)library(ggplot2)library(nleqslv)library(deSolve)library(scatterplot3d)

1. 差(微)分方程

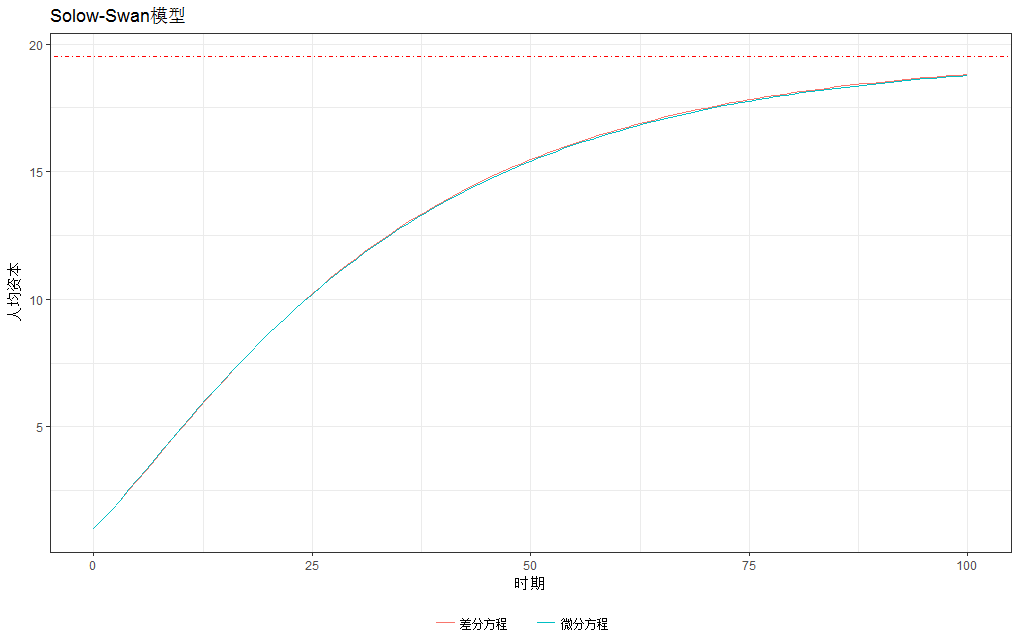

1.1 Solow-Swan模型

delta=0.05; s=0.4; A=1; alpha=0.3 # 设定参数K=1; times = seq(0, 100, by = 1) # 初始值和时间轴# 求稳态资本 KstarFunKstar<-function(Kstar) {error=s*A*Kstar^alpha - delta*Kstar # K_t+1 - K_t =0return(error)}library(nleqslv) # 调用程序包,内含命令nleqslv求解非线性方程(组)Kstar=nleqslv(5,FunKstar)$x# 解差分方程disK=rep(K,length(times))for (t in 2:length(times)) disK[t]=s*A*disK[t-1]^alpha + (1-delta)*disK[t-1]disK=data.frame(times=times,`差分方程`=disK)# 解微分方程Kfun=function(t,K,par){with(as.list(c(K,par)),{dK= s*A*K^alpha - delta*Klist(dK)})}conK= ode(y=c(K=1), times=times, func=Kfun, # ode:程序包deSolve中命令,解常微分方程parms=c(delta=delta,s=s,A=A,alpha=alpha))# 合并数据,作图Capital=data.frame(times=times, `微分方程`=conK[,-1])%>%left_join(disK,by="times")tail(Capital,5) # 最后5期结果比较ggplot(Capital%>%gather(var,K,-times), aes(times,K, color=var))+geom_line()+geom_hline(yintercept=Kstar,linetype = "dotdash",col="red")+labs(title="Solow-Swan模型",x="时期",y="人均资本")+guides(color=guide_legend(title=NULL))+theme_bw()+theme(legend.position="bottom")

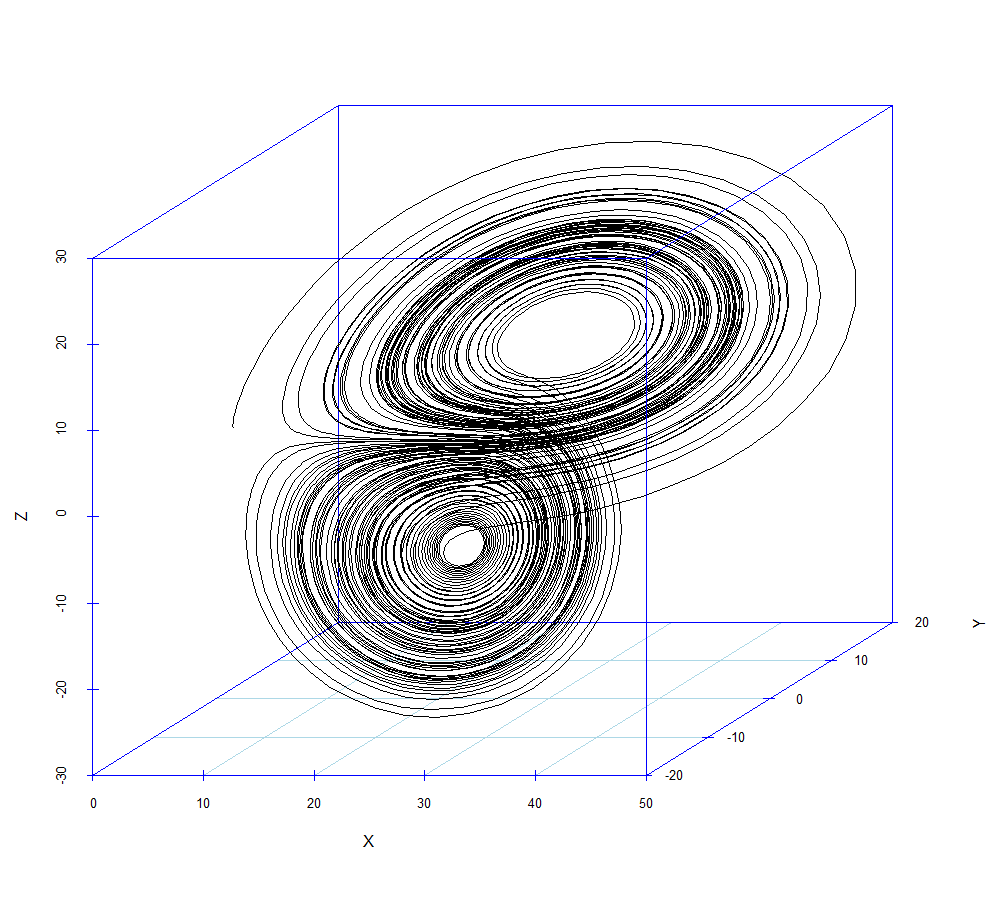

1.2 洛伦兹方程与混沌

parameters <- c(a = -8/3, b = -10, c = 28)state <- c(X = 1, Y = 1, Z = 1)times <- seq(0, 100, by = 0.01)Lorenz <- function(t, state, parameters) {with(as.list(c(state, parameters)), {dX <- a * X + Y * ZdY <- b * (Y - Z)dZ <- -X * Y + c * Y - Zlist(c(dX, dY, dZ))})}out <- ode(y = state, times = times, func = Lorenz, parms = parameters)scatterplot3d(out[,-1], type = "l", highlight.3d=TRUE, col.axis="blue", col.grid="lightblue")

2. 马尔可夫链与稳态人口分布

# 自已写一个可以计算矩阵的幂的函数mat_power = function(A, n){Apower=Afor (i in 2:n) Apower= Apower %*% Areturn(Apower)}P=matrix(c(0.95,0.05,0.03,0.97),nrow=2,byrow=T) # 人口迁移的转移矩阵P_star=mat_power(P,300) # 计算稳态转移矩阵round(eigen(t(P))$values,2) # 求特征值ev=eigen(t(P))$vectors # 求左特征向量x=ev[,1]/sum(ev[,1]) # 将特征值为1的特征向量正规化# 比较三种稳态人口比例xx%*%PP_star[1,]

3. 随机过程(选读,更多材料参见《金融数据处理与分析》)

3.1 获取宏观和金融数据

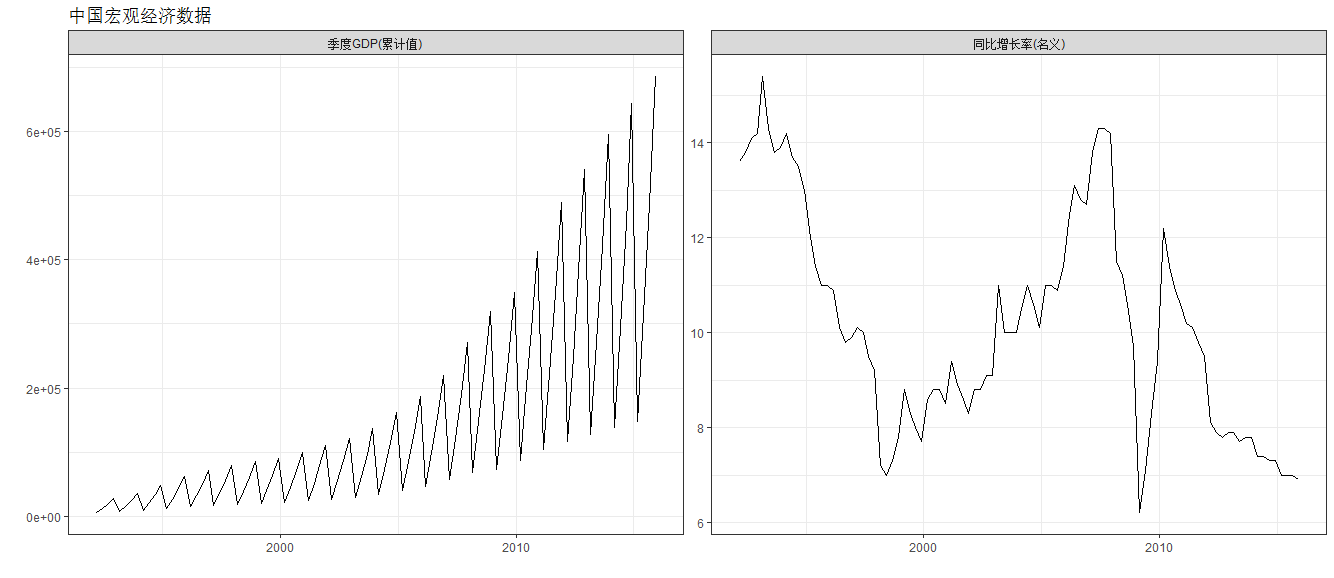

学校电子图书馆有很多中文数据库,下面以国泰安中季度国内生产总值为例,说明宏观经济数据的特征。

Qgdp=read.table("CME_Qgdp.txt", header = T, stringsAsFactors =F)# summary(Qgdp); str(Qgdp) # 查看数据结构library(zoo)Qgdp=Qgdp%>%mutate(time=as.yearmon(Staper))%>%rename(`季度GDP(累计值)`=Gdpq0101)%>%rename(`同比增长率(名义)`=Gdpq0105)%>%select(time,`季度GDP(累计值)`,`同比增长率(名义)`)ggplot(Qgdp%>%gather(var,value,-time),aes(time,value))+geom_line()+facet_wrap(~var,scales="free")+labs(title="中国宏观经济数据",x="",y="")+theme_bw()

用quantmod包中的getSymbols()函数从yahoo财经下载上证综指,更多指标可以查看相关网站。

library(quantmod)ssec<-getSymbols("^SSEC",from = "1991-07-15",to = Sys.Date(),src = "yahoo",auto.assign=FALSE)dim(ssec)tail(ssec)plot(ssec$SSEC.Adjusted, main = "上证综指(SSEC)")ssec.m<-to.monthly(ssec) # 转换成月度数据chartSeries(ssec.m,type="candlesticks",theme="white", name = "上证综指月线图",time.scale = "",up.col="red",dn.col="green")

3.2 数据平稳性检验

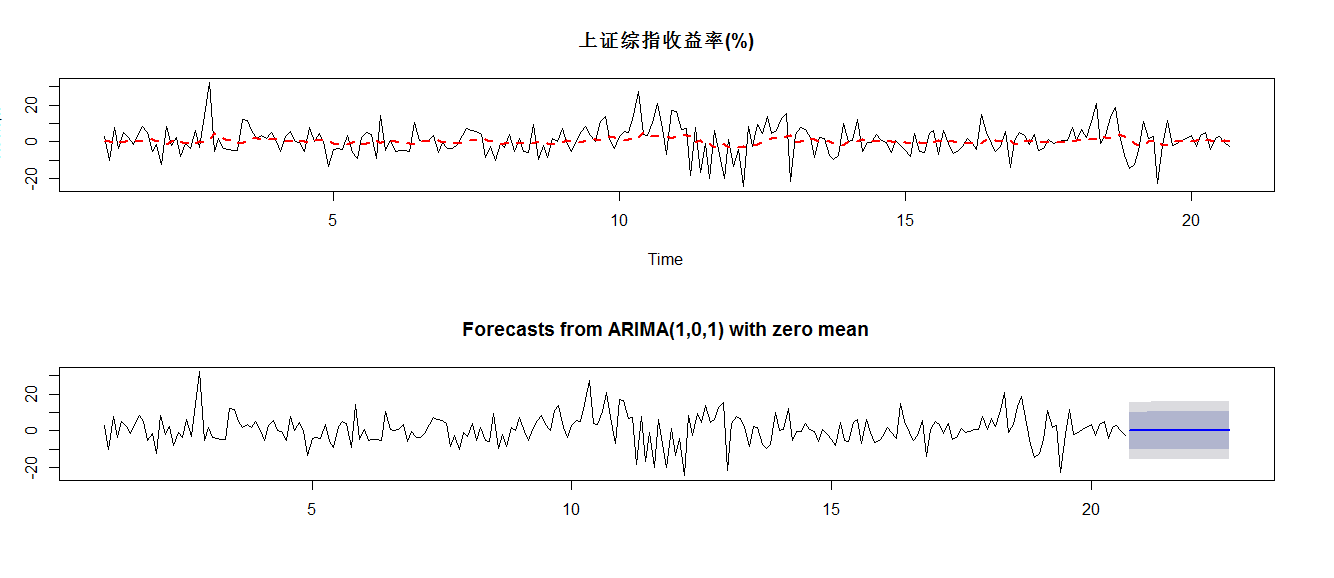

ln_ssec=log(ssec.m$ssec.Adjusted)# 计算月收益率,由于月收益率可能较大,不用diff(log(x))ssec.m$ret=diff(ssec.m$ssec.Adjusted) / lag(ssec.m$ssec.Adjusted) * 100ret=ssec.m$ret[-1,] # 去掉第一行缺失值plot(ret, main="上证综指月收益率(%)")library(tseries)pp.test(ln_ssec) # DF检验,H0:有单位根pp.test(ret)adf.test(ln_ssec) # ADF检验,H0:有单位根adf.test(ret)kpss.test(ln_ssec) # KPSS检验,H0:平稳kpss.test(ret)

3.3 平稳时间序列的ARMA模型

实际应用中,forecast 包中的 auto.arima() 命令,可以自动识别 ARIMA(p,d,q) 中各个阶数,非常方便。

library(fBasics)basicStats(ret) # 对月度收益率的基本统计描述t.test(ret) # 均值检验 H0: x=0normalTest(ret,method='jb',na.rm=T) # 正态分布检验,JB-testpar(mfcol=c(1,1))acf(ret, lag=12, plot=T) # 自相关系数作图Box.test(ret,lag=6,type='Ljung') # m阶自相关系数为零的检验library(forecast)stock=auto.arima(ret,stationary = TRUE, seasonal = FALSE,ic="aic")# 拟合与预测par(mfcol=c(2,1))plot(stock$x, lty = 1, main = "上证综指收益率(%)")lines(fitted(stock), lty = 2,lwd = 2, col = "red")predict(stock, n.ahead=3)plot(forecast(stock))