@SmashStack

2017-08-13T08:36:16.000000Z

字数 8616

阅读 1491

Political connections and SEC enforcement

Chore

文章链接:Political connections and SEC enforcement

作者信息:Maria M.Correia @ London Business School

Abstract

文章属于相关性分析,其主要分析对象及结论如下:

- 分析对象:企业对政府的投资 <--> 企业收到SEC强制政策的影响

- 理论支持:Groups of individuals compete for wealth transfers by offering political support in the form of money or votes to regulators. (This exchange often takes place in the context of long-term relationships between firms and politicians.)

- 分析结论:

- 涉及政府投资 (political connections through contributions and lobbying) 的企业,更不容易包含在SEC强制政策行为 (enforcement actions) 影响的对象中

- 在面对SEC起诉时,涉及政府投资的企业会面对更低的处罚 (penalties)

- 拓展结论:涉及SEC的投资项目金额明显比其他投资更有影响力 (The amounts paid to lobbyists with prior employment links to the SEC, and the amounts spent on lobbying the SEC directly, are more effective than other lobbying expenditures at reducing enforcement costs faced by firms)

Motivation

现在的会计学在对SEC影响的研究上略显苍白,尽管现在有了针对于SEC的研究课题 AAERs, 大部分现有研究也没有对SEC政策的对象有足够深入的发掘。本文弥补了这个研究方向上的空缺。

(The accounting literature has not dedicated much attention to SEC enforcement. In fact, while many studies rely on the SEC's Accounting and Auditing Enforcement Releases (AAERs) to examine the determinants of accounting fraud, they ignore the choice of enforcement targets by the SEC and the impact of political influence on this choice.)

Contribution

- 研究了SEC的强制政策

- SEC的强制政策如何被政治影响

- 通过企业的政策性支出预测其是否可以影响SEC的强制政策

(The main contribution of this paper is to study SEC enforcement and how it is affected by political influence. The paper also provides additional evidence on whether firms can influence the enforcement decisions of an independent agency through political expenditures.)

Hypotheses development

背景介绍

下图为SEC Enforcement的典型时间线,参考至 Karpoff et al. (2008a).

(The SEC has limited resources. As a result, it cannot monitor all firms or investigate all leads. Both the SEC staff and the commissioners have discretion regarding enforcement outcomes)

太长,人蠢,翻不动哈哈哈哈哈。

(An enforcement action typically begins with a trigger event, such as a restatement, that the staff decides to investigate. At the end of the investigation, the staff can make an enforcement recommendation to the commission that can in turn authorize the filing of a civil or administrative action. If an action is authorized, then a complaint or an order is filed that describes the misconduct and the sanction or remedial action sought. The staff has more discretion at the initial stages of the process on which leads to pursue, whether to start an investigation, and on the final enforcement recommendations made to the commission (SEC, 2013). In turn, the commissioners must decide whether to file a civil or administrative action, which penalties to demand, and whether to warn the Department of Justice (DoJ) (SEC, 2013). The commission also serves as a first appellate court in administrative proceedings and contributes to the definition of enforcement priorities, which constrain to some degree the staff's resource allocation choices in the initial stage.)

基本假设

- 长时间政治相关的公司更不容易被SEC惩罚,即使被惩罚,从平均化意义上讲也会支付更少的罚金(Firms with long-term political connections are less likely to be prosecuted by the SEC and, conditional on being prosecuted, on average pay lower penalties.)

- a. 太长拒翻(Long-term political contributions are associated with a greater reduction in the probability of enforcement and in the penalties imposed at the end of an enforcement action when their recipients are the high-ranking members of the committees with the highest control over the SEC and have a long-term, repeated relationship with the firm.)

- b. 拒翻 😡 (Long-term lobbying expenditures are associated with a greater reduction in the probability of enforcement and the penalties imposed at the end of an enforcement action when lobbying is made through lobbying firms with connections to the SEC or when the firm lobbies the SEC directly.)

数据处理

Political connections

政策性通过企业的 PAC 贡献和游说开支表现。

(I measure political connections by the amount of PAC contributions and lobbying expenditures made by the firm.)

1. PAC contributions

A PAC is a political committee that is organized to raise money to elect or defeat candidates.

PAC 数据的贡献来源于 the Federal Election Commission's website (链接可能需要科学上网)

(The data on PAC contributions comes from the Federal Election Commission's (FEC) website (www.fec.gov).)

数据处理方法如下:

- Match each Compustat firm to the connected organization field in the “Committee Master” files to determine whether the firm has a PAC in each election cycle.

- Then, match these databases with both the “Contributions to Candidates from Committees” and the “Candidate Master” files to obtain information on the timing and the recipients of all of the contributions made by the firm between 1979 and 2006.

- Next, Match all of the recipient candidates by name to Charles Stewart III and Jonathan Woon's Congressional Committee Assignments, 1993–2007, and Garrison Nelson's Committees in the U.S. Congress, 1947–1992, databases, which are available from the Charles Stewart III website.

Above matching allows us to track the committee assignments for each candidate over time.

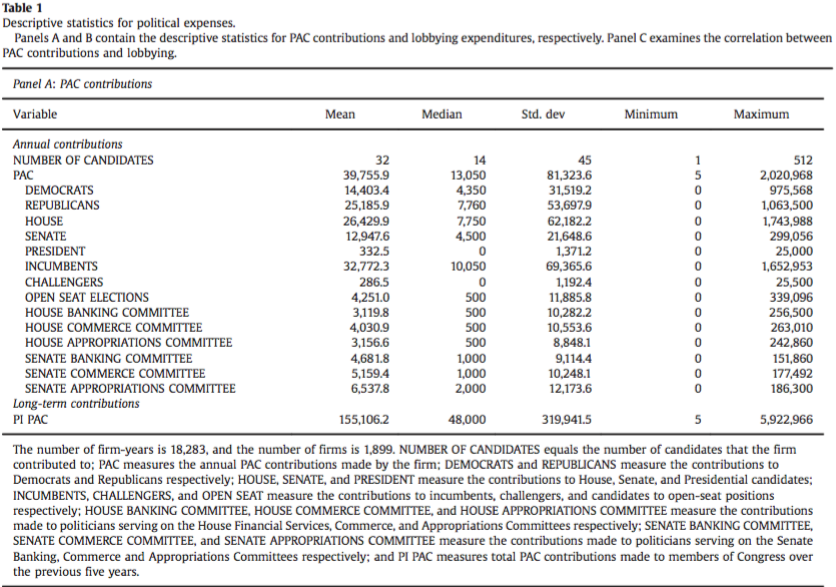

Over the sample period (1980–2006), the contributing firms spent an average of $39,756 in PAC contributions to 32 candidates per year, with some spending more than $2 million and contributing to more than 500 candidates. Over a five-year period, the contributing firms on average give $155,106 in PAC contributions.

2. Lobbying

Lobbying is the strategic transmission of politically relevant information. Firms spend large amounts of money to lobby Congress and federal agencies. Lobbying typically takes place behind the scenes and occurs at the highest levels of the organizations (usually by the CEO and other executives). Unlike PACs, lobbying expenditures are not capped.

数据来源:The CRP compiles the lobbying data from the quarterly lobbying disclosure reports filed with the Secretary of the Senate's Office of Public Records (SOPR). This data is available from 1998 onwards. Lobbying expenses cannot be traced to specific politicians. If a firm lobbies an individual congressman, the disclosure report indicates that the firm lobbied the “U.S. House of Representatives” or the “U.S. Senate.” If a firm lobbies bureaucratic agencies, these must be listed in the report. I use this information to identify firms that have a history of lobbying the SEC. The determination of the amount of expenses that were allocated to lobbing each agency is not possible, as firms are not required to disclose this information.

数据处理方法如下:

Classify a lobbying firm as having a link to the SEC if one of the following conditions is met:

1) the firm employs a lobbyist who has previously worked at the SEC

2) one of the current SEC commissioners or staff members previously worked for one of the lobbyists employed by the company.- With this link, attempt to measure both the lobbyist's knowledge of the inner workings of the SEC and the presence of social connections between the lobbyist and the SEC's staff and commissioners.

- Compute this link using the CRP's revolving door data. The CRP compiles this data from proprietary and publicly available sources, including a directory of lobbyists published by Columbia Books, Inc. and collected biographical information on federal government employees.

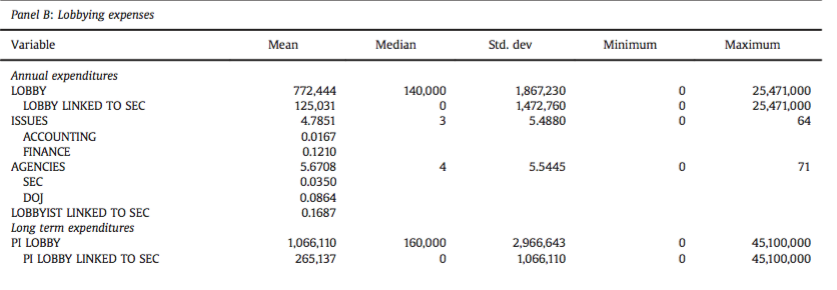

There are 2,623 firms that lobbied from 1998 to 2006 (and that I could match to Compustat manually by name) that spent an average of $772,444 per year (Table 1, Panel B). During the sample period, the firms lobbied an average of six agencies per year on five issues, and 1.67% of these issues were related to accounting. However, lobbying on other issues also related to the SEC, such as finance issues, is more frequent, occurring in 12% of the cases. Direct lobbying of the SEC and the DoJ occurs in 3.5% and 8.6% of the observations respectively. Each year, 16.87% of the lobbying firms employ at least one lobbyist linked to the SEC. They pay $125,031 on average to these linked lobbyists. Over a three-year period, the firms spend over $1 million on average for lobbying of which $265,137 is spent on lobbyists linked to the SEC. Over the same period, 9.75% of the firms on average lobby the SEC. I compute long-term lobbying expenditures over a three- rather than a five-year period for consistency with the remainder of the paper. For the enforcement and penalty analysis, calculating lobbying expenses over a five-year period substantially reduces the sample size given that lobbying data is only available from 1998.

Lobbying and PAC contributions exhibit a correlation of 0.405 (Panel C) and occur in 4.71% of the sample firm-years. In fact, PAC contributions can be used to obtain access to politicians in order to lobby them (Milyo et al., 2000). However, lobbying often occurs without PAC contributions and vice versa (in 8.47% and 2.4% of the sample years respectively).

在上述的测算中,有两个数据处理的关键点:

- Corporate political spending is very hard to track, and these expenditures are just a fraction of the total spending

- Most of the political influence might occur through social links without an exchange of money.

SEC enforcement

This paper rely on an extensive database of enforcement actions by Karpoff, Lee, and Martin (hereafter KLM). This database contains detailed information on the SEC enforcement actions for financial misrepresentation starting in 1978.

数据来源: KLM (404 Not Found)

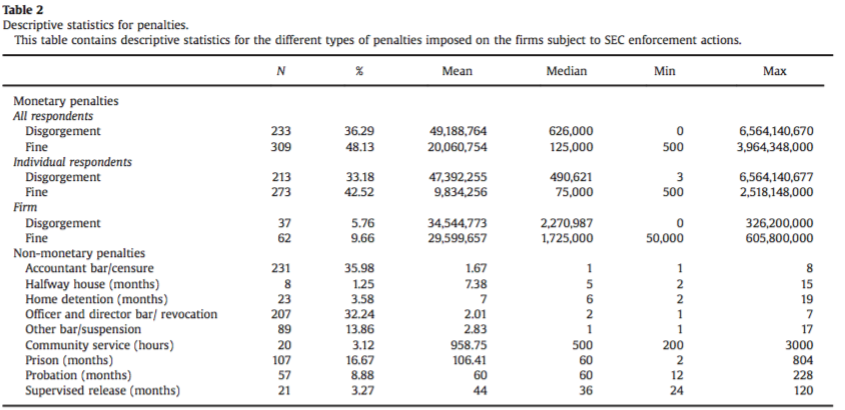

Table 2 contains the descriptive statistics for the different penalties. There is disgorgement of ill-gotten gains in 36.29% of the cases and fines in approximately 48% of the cases. Most of these are imposed on individual respondents. The firm only had to disgorge in 5.76% of the cases and pay fines in 9.66% of the cases. These percentages occur in part because monetary penalties on the firm ultimately fall on shareholders, something that the SEC likes to avoid. In 35.98% of the cases, there is some type of accountant bar/censure; and in 32.24% of the cases, respondents are barred from serving as officers and directors either for a short period of time or indefinitely. There are prison sentences in 16.67% of the cases.

经验性分析

看不懂呀看不懂呀